What is Tiered Pricing for Credit Card Processing?

If you take credit or debit card payments, you have an account with a merchant services provider. These merchant accounts have a variety of fees. Some are periodic, and others change based on certain purchases or a percentage basis. Often the merchant account provider is setting these fees. However, it is also possible that the bank issuing credit and debit cards is setting rates called interchange fees. These are set by the big credit card issuers like Visa, Discover, and MasterCard. These providers break these processing rates into the following categories: qualified, mid-qualified, and non-qualified. So, what do these categories mean for your business?

What are Qualified, Mid-Qualified, and Non-Qualified Rates?

In a nutshell, these categories refer to different transaction rates. It varies based on the type of transaction you’re processing. It can be hard to tell which purchase at your business is a qualified, mid-qualified, or non-qualified processing rate. The fee depends on the card type and the circumstances of the transaction. For example, a customer purchasing a t-shirt in your vintage store using a VISA card issued by a major bank is more than likely going to be a qualified processing rate. While a customer purchasing the same t-shirt using a cash-back credit card will likely be a mid or non-qualified processing rate.

The reality is that as your business goes through its average day, there would be no way to categorize all the purchases. However, the main point is this: Qualified is the best—or least expensive transaction to process. Then mid-qualified, and lastly non-qualified—the transaction type with the highest fee.

Qualified: This rate is the percentage rate your business is charged when it accepts any regular consumer credit card. The technical term defines this processing as the standard by their merchant account provider. It is the lowest rate your business has to pay when processing a purchase on a credit or debit card. Merchant service providers define this rate based on the way your business will be accepting most credit card purchases. Keep in mind that a qualified rate must be a consumer card. Most of these purchases are made with cards that have no rewards attached to them. They usually involve simple debit cards issued by major banks. Beware of sales reps who may only quote you this rate! It might seem like the best option but it’s the Mid-Qualified and Non-Qualified rates they fail to mention and before you know it you are locked into a painful long term commitment.

Mid-Qualified: Otherwise known as a partially qualified rate. Mid-Qualified is the percentage your business is charged whenever it accepts a credit card that does not qualify for the lowest rate. Credit card purchases fall into this category for several reasons. First, it could be because the card was manually entered into a processing terminal, not swiped or inserted. Second, it could be a credit card that uses rewards, airline points, or cash-back. Believe it or not, your business probably processes many purchases at this rate. Most major credit card issuers and banks offer lines of credit with rewards and cash-back promos. For example, when you see a customer using an airline credit card, it is almost always a mid-qualified rate.

Non-Qualified: this is the highest processing fee your business is charged when accepting a credit card. Most credit card purchases made at your business will fall into this or the mid-qualified category. In any case, this is the processing rate that starts to increase the cost of processing purchases at your business. Purchases keyed into a terminal with no address verification will fall under this rate. Additionally, special credit cards like international, rewards, business, or signature cards will fall into this category.

The reality of these different categories isn’t that you need to increase one or the other. You just need to make sure that you aren’t losing thousands of dollars in processing fees to your merchant services provider. Some may overcharge businesses that have high amounts of mid or non-qualified purchases. Some merchant service providers, like Titan, eliminate non-qualified processing fees and save businesses thousands.

What is Interchange Plus for Credit Card Processing?

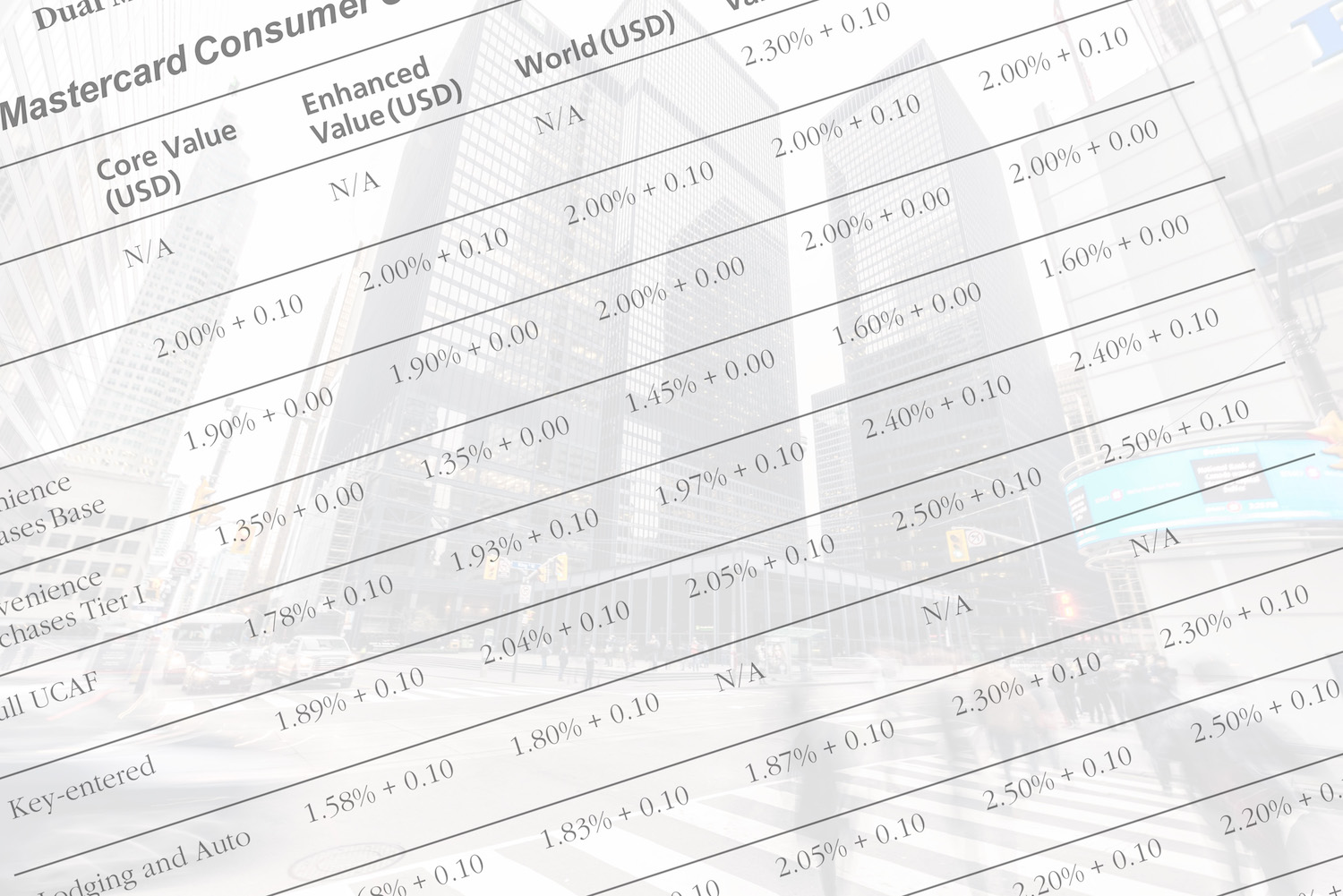

It is possible to eliminate the costs associated with non-qualified transactions. To do so, you need to stop your merchant services provider from assigning transaction tiers. This may sound intimidating and complicated. However, it is a fairly simple process. You need to ask your merchant services provider to use interchange pass-through pricing to set processing rates. It is more cost-effective and transparent than tiered pricing. Under this model, your business will be charged interchange fees plus a fixed markup. The interchange rate is set by the credit card companies—such as Visa, Mastercard, etc. You won’t be charged based on the number of qualified, mid-qualified, or non-qualified purchases. In other words, with pass-through pricing your merchant services provider will charge you a fixed rate per transaction. So, for example, your business would pay the interchange cost + 0.20% markup on all transactions regardless of their status as qualified or non-qualified.

Choosing this pricing model will eliminate the high processing fees associated with mid and non-qualified purchases and could save your business thousands in the long run. Best of all, you can discuss the pricing model with your merchant service provider. If they aren’t willing to make adjust your pricing model, you can always find a new provider.

What is Flat Rate Pricing for Credit Card Processing?

Interchange plus, as discussed above, involves a form of flat rate pricing. However interchange fees can still vary based on card types. So while it is the lower cost option, at the end of the day it still can be a bit unpredictable. This is why some merchants like transparency, predictability and no surprises. That’s the essence of a Flat Rate Pricing Program. In essence, the rate remains the same across all credit cards you accept regardless of their qualification. However, keep in mind that the rate can change depending on how the card was entered into a terminal. For example, when the card is entered manually—not swiped or inserted—the rate will be higher because the transaction would be considered “high-risk” of possible chargebacks. If you want to escape overpaying transaction costs associated with a tiered pricing model, you may want to investigate Titan’s flat rate program called FlatPay. You can read more about that here.

Let’s compare flat rate pricing models.

Square, a payment aggregator, currently (as of 1/1/2022) charges a flat rate of 2.6% + 10¢ per swiped transaction. So, let’s figure out the same cost to your business if you are processing $25 dollar tickets.

25 x (2.6% + 10¢ p/t) = 75¢ per ticket.

Titan’s flat rate program is 2.7% + 0.00¢ for in person transactions. So, if a customer runs a $25 transaction, the cost to your business would be the following: 25 x (2.7% + 0.00¢ p/t) = 67¢ per ticket sale.

7¢ per transaction might not seem like a lot, but it can add up quickly. For example, if you run 1,000 transactions over the course of a month, that would be $70 in savings — every month. That comes out to $840 per year!

Another factor to consider is the pricing for running a transaction when the card is not present. Square charges 3.5% + 15¢ for card-not-present transactions. Following the model above, that would come to $1.02 in fees on a $25 transaction.

On the other hand, Titan charges 3.25% + 0¢ for the same transaction type. For a $25 transaction, you would pay 81¢ — a difference of 21¢! At 1,000 transactions per month, that comes to $210. Over the course of a year, that is $2,520 in savings!

Understanding flat rate pricing models is crucial to finding the best quote for your business. Sometimes flat rate pricing is most cost-effective, but it can’t be taken for granted. It’s important to balance the percentage rate and transaction fee. For example, a merchant services provider might set a competitive flat rate, but with a high transaction fee. The result could be pricing that’s just as expensive as a tiered pricing model. Beware: Aggregators may end up placing holds extensive holds on your deposits as well. Finding the right processor is crucial to saving money and having access to it!

Out With the Old, In With the New

Choosing a pricing model for your business’ processing can feel overwhelming. The whole process for transactions between businesses, card issuers, and banks is more complicated than it appears—which explains the trouble of trying to determine the right pricing model for your business. For example, a transaction is not just an interaction between you and the customer. It is you, the customer, the bank, and the card issuer. All those entities must communicate together to complete the purchase. It only becomes more complicated when you consider the type of card used, the industry of the business, or whether the transaction is online or in-person. A lot goes into every purchase made at your store. So, how do you make sure you’re finding the right merchant service provider that will keep your transaction costs low? You want to focus on how they set your processing rates. Are they using tiered pricing or interchange plus?

Most businesses are on a tiered pricing model. These are often less clear and more expensive than newer models. Under this type, transactions follow the qualification system, which means they determine at which rate (qualified, mid-qualified, or non-qualified) to charge per transaction. As previously mentioned, each of these different “buckets” will have an associated percentage that your business will pay for the transaction. For example, a qualified rate could be 1%, while a non-qualified rate could be 3%. Often, these rates are not so black and white. Merchant service providers can also have various middle categories with their respective rates.

The up-and-coming new pricing model is interchange plus. For years this type of pricing account was locked behind closed door. Your business had to have a certain number of credit card sales to qualify for it. However, as credit cards became more popular among consumers, the merchant services industry became more competitive. As a result, many service providers are offering interchange plus models to all businesses regardless of size. This model may benefit your company. It is straightforward. There are only two fees a business must consider: your markup rate plus the transaction fee. Best of all, the fee is fixed. It never changes—even with different credit cards. As an example, your fee could be .30% with a .15 cents transaction fee. Your business would pay the wholesale interchange fee, plus the .30% and the transaction fee. While the fixed rate is attractive, it’s important to keep in mind that the wholesale interchange rate is not set. This is the fee that is set by the credit card issuer and varies from one to another.

What is the best pricing model for my business?

This question ultimately requires some reflection on your business. Each of the processing payment models have unique pros and cons. Which one is right for you depends a lot on your business. Below are some key summarizations of each pricing models to help you pick the best one for your business.

Interchange-Plus: This model uses interchange fees plus markups by the payment processor. The markup is calculated as a percentage of the transaction amount plus a flat fee. Interchange plus is a highly transparent pricing model. You can identify interchange costs and the processor markup. It also makes it easy to compare total costs among many different merchant service providers. That transparency also leads to lower prices for your business. On the other hand, the statements you receive every billing period can be complicated to read. They are not straightforward when trying to break down everything, which can be frustrating for some business owners.

Pros: Transparent; Easy to compare prices; Lower cost

Cons: Confusing statements; Difficult to predict exact cost

Flat Rate Pricing: This is probably the easiest model to understand. It charges your business a fixed rate for every transaction. Unless you are already with Titan Merchant Services, a flat charge per transaction is also usually added to your business’s costs. The simplicity and predictability of flat rate pricing is the greatest advantage of this model. You can easily predict the monthly cost of your transactions. The major downside is that you have a higher likelihood of overpaying for processing. With flat rate pricing you may not be getting the absolute best rate possible, but you’ll know exactly what you’re going to pay.

Pros: Easy to understand; Easy to predict cost

Cons: Higher risk of over-paying

Tiered Pricing: This model utilizes the qualifications discussed previously. So, different credit card transactions at your business will produce specific pricing rates. These qualifications are established by the payment processor. Qualified transactions produce the lowest rate. However, there are several reasons that a transaction may be downgraded—such as how the card info was entered into the terminal, or the type of credit card. The main advantage of this pricing model is that statements are easy to read and see how your transactions are broken up into the categories. The disadvantage of this model is that you will never know the real cost of your payment processing. Transactions are routed in pre-established tiers and the assigned rate is concealed from your business. Your merchant service provider probably advertises the rate of qualified transactions. However, the number of purchases that fall into this category is more than likely the lowest.

Pros: Concept may be easy to understand

Cons: Not transparent; Pricing can be misleading

Thinking Outside the Box

The pandemic has wreaked havoc on many businesses. Many small businesses have looked for creative ways to offset costs. One option used by many businesses is a collaboration between merchants and their processor. The idea is to completely remove any processing fees to the business. The business’ credit card machine is programmed to bundle the credit card processing fee as part of the transaction. That fee directly covers the cost of the transaction, and the business never has any fees come out of their account. You can read more accepting credit cards for free here.

Another creative solution is offering a cash discount to customers. The way it works is, the business advertises their prices to include their processing costs. At checkout customers are offered a percentage discount on their purchase if they pay in cash. This does two things: The first is, it incentivizes customers to use cash rather than card, which lowers processing fees. The second is, it helps offset the cost of accepting cards if they choose to pay the advertised price. To start offering a cash discount, the business marks up all items by the specified percentage—maybe 3-4%, for example. That marked up amount goes to the merchant to offset the fees they pay for accepting cards.

A Final Word

At Titan Merchant Services, we take the time to get to know your business model. With our expert knowledge of these pricing models, we can help you pick the plan that will save you the most on your transaction costs, give you the peace of mind and help you succeed. We take great pride in helping merchants save money by matching them with the program that is best for them. Give us a call today and get a free customized quote for your business.