On this page

Employees love Fridays.

Employers and business owners? Not so much.

I’ve been both an employee and an employer, and felt both sides.

Here’s what a typical thought process of an employer looks like on a Thursday night lying in bed, staring at the ceiling, doing mental math.

“Tomorrow is payday. My team is expecting their direct deposit bright and early Friday morning. But that big invoice payment? Still sitting in “pending” limbo.”

Sound familiar?

I’ve been helping small business owners navigate this exact nightmare for years now.

And here’s what I’ve learned: the payroll process doesn’t have to feel like you’re defusing a bomb every two weeks.

Most owners I talk to say payroll week is their most stressful time. They’re not wrong. According to U.S. Bank, 82% of small businesses fail because of cash flow issues. And nine times out of ten, it’s because they can’t bridge the gap between when money comes in and when employee wages need to go out.

But here’s the thing.

It doesn’t have to be this way.

A True Story of a Broken Payroll Schedule

Let me paint you a picture.

Your business income is like a river. Sometimes it’s rushing, sometimes it’s a trickle. Maybe you get three big payments a month, or your sales are seasonal. That’s normal.

But your payroll schedule? That’s like a dam that needs to be filled to the exact same level every pay period. When the river runs low, even for a few days, you’re scrambling. According to Quickbooks, 42% of small businesses report cash flow issues within the last year, with payroll being the top stress point.

True Story:

I had a client who ran a small landscaping business. He finished a big commercial job on Friday, but the check wouldn’t clear until the following Tuesday. Meanwhile, his crew expected their paychecks that same Friday. With no cash in the bank, he took a credit card cash advance, paying a 3–5% fee right off the top, just to cover payroll. It solved the problem in the moment, but that fee ate directly into his margins.

What good is being profitable on paper if you can’t make payroll on Friday?

The truth is, most small business owners aren’t equipped to handle the complexity of modern payroll compliance. Between federal payroll taxes, state and federal regulations, and the Fair Labor Standards Act (FLSA), there’s a lot that can go wrong when you process payroll manually.

The Real Cost of DIY Payroll Compliance (Spoiler: It’s More Than You Think)

I get it.

When you’re starting out, doing your own payroll feels like the scrappy thing to do.

You’ve got your spreadsheet, maybe some basic accounting software, and you’re calculating wages by hand.

But here’s what that manual payroll approach is really costing you:

Time you can’t get back.

Every hour you spend figuring out gross pay, tax deductions, and withholding taxes is an hour you’re not growing your business. One client told me she was spending eight hours every pay period just on payroll processing work.

Sleep-stealing stress.

When you’re responsible for employee’s net pay calculations, overtime pay formulas, and making sure you’re compliant with wage and hour laws, every payroll cycle becomes an anxiety fest. Add dealing with appropriate government agencies on top of that? And you are sure to get nightmares.

Expensive mistakes.

Get your payroll tax calculations wrong? The Internal Revenue Service doesn’t care that you’re learning. Research shows that nearly a third of small businesses get fined for incorrect payroll practices each year. Tax penalties add up fast. I’ve seen small businesses hit with thousands in fines because they miscalculated Medicare taxes or federal unemployment tax.

Compliance nightmares.

Employment eligibility verification, retirement plan documents, tax forms, the list of requirements keeps growing. Miss something, and you’re dealing with government agencies asking uncomfortable questions.

The scariest part? Many small business owners don’t realize they’re making payroll errors until it’s too late.

My Battle-Tested Strategy for Complete Payroll Sanity

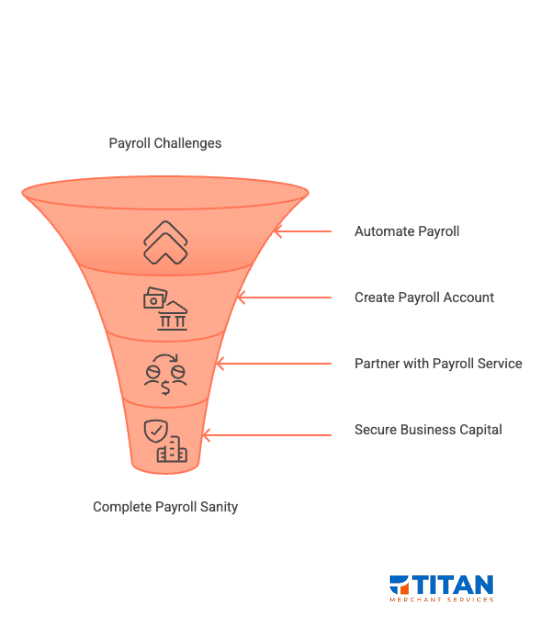

Through years of trial and error (and a a lot of sleepless nights), I’ve developed a four-step approach that works:

Step 1: Stop Playing Accountant and Start Automating with a Payroll Processing Software

Listen, you didn’t start your business to become a payroll tax expert. Trying to manually calculate gross pay, figure out pre tax deductions, and keep track of employee records is like trying to cut your own hair. Technically possible, but probably not going to end well.

Good payroll processing software changes everything. It handles the heavy lifting: federal income taxes, Medicare taxes, state taxes, even complex stuff like retirement plan contributions. The right payroll software automates everything from employee bank accounts setup to ensuring you’re compliant with federal regulations.

I always tell my clients: you wouldn’t do your own surgery, so why do your own payroll calculations?

Step 2: Build The Payroll Firewall for Your Small Business

Here’s a trick that’s saved countless businesses from payroll panic: create a separate bank account just for employee wages.

Every time money hits your main account, immediately transfer what you need for the next pay period into your dedicated payroll account. This payroll method ensures your team always comes first, no matter what other expenses pop up.

One bakery owner I work with swears by this approach. She had a walk-in freezer die during a July heatwave. The repair was $3,000 she didn’t expect to spend. But because her payroll money was locked away in its own account, she didn’t have to choose between fixing equipment and paying her staff.

Step 3: Find a True Payroll Partner, Not Just a Payroll Software

Most payroll services handle the basics—they’ll process your payroll and handle tax filing. But the best ones act like an extension of your team.

I’m talking about a payroll partner who helps with employment eligibility verification for new hires, keeps your retirement plan documents organized, and makes sure you’re not accidentally violating minimum wage requirements or overtime pay rules.

The right payroll vendor doesn’t just calculate pay—they protect your business from unfair pay practices claims and keep you compliant with the maze of federal law requirements.

Step 4: Secure a Payroll Safety Net with Business Capital

Even the best-run businesses hit unexpected cash crunches. A late client payment, an emergency repair, or a seasonal dip in sales can leave you staring at payroll deadlines with an empty operating account. That’s when a financial buffer isn’t just helpful—it’s essential.

54% of businesses are forced to take out a loan due to missing payments.

This is where Titan business capital services come in. Think of it as a built-in backup plan: access to working capital, a line of credit, or short-term financing that bridges the gap between outgoing payroll and incoming revenue. Instead of swiping personal credit cards or delaying vendor payments, you can draw on a flexible funding option designed for moments just like this.

One of my clients, a retail shop owner, used to dread the holiday off-season. Sales slowed every January, but payroll stayed the same. By setting up access to our business capital services, she was able to cover her payroll seamlessly and repay once revenue picked up again in spring. No more sleepless nights.

The Missing Piece: Cash Flow That Actually Flows with Pay Period Rollover

Even with perfect payroll software and bulletproof systems, there’s still one problem: slow money.

You can have the most sophisticated payroll processing software in the world. But if the cash isn’t there when you need to pay employees, all that automation doesn’t matter.

I’ve watched businesses with complete payroll systems still struggle because their money was tied up in credit card processing delays or slow-paying clients. One restaurant owner told me she had to borrow against her own credit card three times in one month just to meet her payroll, despite having outstanding invoices worth twice what she needed.

The real solution isn’t just better payroll software or fancier accounting software. It’s fixing the underlying cash flow problem that makes payroll stressful in the first place.

This is where Titan Merchant Services comes in. We give small and mid-sized businesses access to fast, flexible funding designed for moments exactly like this:

- Working Capital Loans & Merchant Cash Advances: Bridge payroll gaps when sales are slow or invoices are late.

- Lines of Credit: Draw only what you need to cover payroll, and pay it back as cash flow catches up.

- Same-Day Funding: Get money in your account within 24 hours so you never miss a payroll deadline.

- Access to 75+ Lenders: Whether you need $10K or $1M, we can match you with the right funding partner.

Think of it as a payroll safety net. You may not need it every week, but when cash flow gets tight, having that lifeline in place keeps your team paid, your operations steady, and your reputation intact.

Stop Losing Sleep Over Payroll Processing

Here’s the bottom line: your payroll process shouldn’t be the thing that keeps you up at night.

Whether you have two employees or twenty, the goal is the same, get your people paid on time, stay compliant with all those federal and state regulations, and sleep soundly knowing your payroll data is accurate and your business is protected. If you’re tired of the payroll panic cycle, if you want to stop worrying about whether you can make your next payroll schedule, we can help.

At Titan Merchant Services, we’ve built solutions specifically for small businesses caught between slow-moving money and fast-approaching paydays. We help you get faster access to your cash so you can confidently process payroll without the stress.

Because running a business is hard enough. Your payroll method shouldn’t make it harder.

Ready to stop letting payroll control your calendar? Let’s talk about how we can help you take back control of your cash flow, and your peace of mind.