On this page

If you’ve ever stared at your bank balance on a Wednesday and wondered how you’re going to make payroll by Friday, you’re not alone. Cash flow crunches happen to good businesses. Revenue is “there” on paper, but cash in the account lags behind. That mismatch is stressful. It also slows growth.

Here’s the good news: next-day business capital exists for exactly these moments. In plain English, it’s fast access to business funds so you can cover business expenses, grab opportunities, and steady your financial management without waiting weeks.

I’ll walk you through how it works, when to use it, and how Titan Capital helps you move from “I hope the invoice clears” to “We’ve got this.”

Blueprint Tip: Apply early in the week. Approvals and deposits tend to move fastest Monday to Thursday.

The cash flow crunch, explained

Cash flow isn’t about being profitable. It’s about timing. Money out (payroll, rent, suppliers) often comes due before money in (card settlements, insurance reimbursements, net-30 invoices).

This is more common than you think. QuickBooks’ latest Small Business Insights shows almost half of small businesses report cash flow problems, and more than half are still waiting over 30 days to get invoices paid. That’s a double whammy: slower collections and ongoing bills.

And while it’s smart to keep a cushion, many firms simply don’t have a big buffer. JPMorgan Chase Institute found 50% of small businesses operate with fewer than 15 days of cash reserves Think about that: two weeks of typical outflows and the tank is empty.

That’s why fast, flexible working capital matters. Not forever. Not as a crutch. As a bridge.

Profitability vs liquidity: Why cash flow management matters more day to day

Profit is your long-term scorecard. Liquidity is your oxygen. You can win on paper and still struggle to breathe if cash is tied up in receivables or inventory. Here’s where owners feel the pinch:

- Payroll and taxes. Payroll isn’t optional, and late tax payments add penalties.

- Rent and utilities. Landlords and utility companies aren’t moved by “the ACH is on the way.”

- Inventory restocks. You can’t sell what you don’t have. Seasonal spikes, supplier minimums, and pre-buys strain cash.

- Repairs and replacements. The oven dies before the dinner rush. The truck needs a transmission. Life happens.

Federal Reserve survey data backs this up: of firms that sought financing, 63% did it to meet operating expenses. Not for fancy expansions. Just to keep the wheels turning.

What is next-day business capital?

It’s any small business funding designed to move quickly—sometimes in as little as 24 hours after approval. That includes:

- Online term loans built for speed.

- Business lines of credit you can draw, repay, and redraw.

- Merchant cash advance (MCA) products that trade a portion of future card sales for upfront cash.

- Invoice financing that advances a chunk of your receivables now.

Traditional bank and SBA loans are useful, but they can take weeks to months to fund. Investopedia pegs SBA timing at 30 to 90 days depending on the program and paperwork.

Online lenders, by contrast, specialize in streamlined applications and faster decisions—often funding within 24 to 48 hours.

Speed isn’t everything. But when Friday is coming, it matters.

When fast business funds make the difference

Let’s make this real with a few quick scenarios.

1) Payroll deadlines

You underestimated overtime during your busiest week. Rather than risking late payroll (and damaged team morale), you tap a line of credit for 48 hours, then repay when your weekend sales settle.

2) Supplier pre-buys and inventory spikes

Your distributor offers a 12% discount if you prepay this quarter’s order. That discount might beat the cost of short-term capital. Next-day funds help you secure the deal and improve margins.

3) Emergency repairs

The walk-in cooler quits in July. You need a new compressor now, not in three weeks. Fast capital covers the invoice, so you don’t toss product (or lose customer trust).

4) Growth opportunities

A nearby competitor closes. Their display cases are for sale at a steep discount. Quick cash lets you expand capacity before your busy season.

These aren’t hypotheticals. Owners tell me versions of these stories every week. And remember, many are already battling slow payments—QuickBooks reports 54% wait over 30 days for invoices to be paid —so a short-term bridge is sometimes the only way to keep operations smooth.

What type of funding fits which need?

You’ve got options. The right fit depends on how predictable your cash flows are, how long you need the money, and your tolerance for cost.

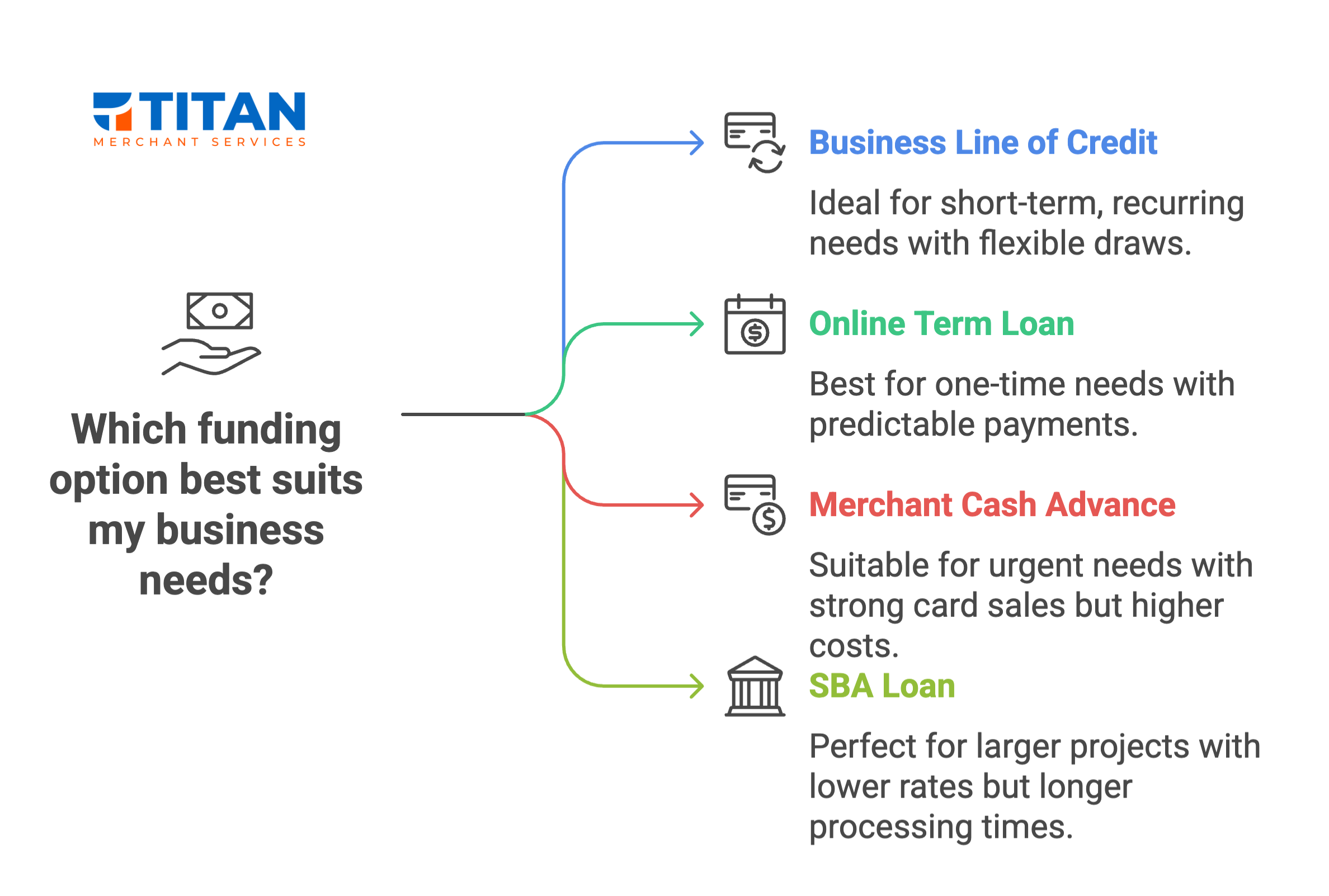

Business line of credit

- Best for: Short, recurring gaps; flexible draws.

- How it works: You’re approved for a limit. Draw only what you need. Interest accrues on the drawn amount.

- Why owners like it: It’s a safety net. You can cover Friday payroll and repay on Monday.

Online term loan

- Best for: One-time needs with a clear payback plan.

- How it works: Lump sum upfront; fixed payments over months or years

- Why owners like it: Predictable payments. Often funds in 24–48 hours with the right lender.

Merchant cash advance (MCA)

- Best for:Urgent needs when you have strong card sales but limited traditional credit options.

- How it works:You receive cash now and repay from a percentage of future card receipts or fixed daily/weekly debits. Faster to get; typically more expensive than loans.

- What to watch: Factor rates can make the true cost high. Terms often involve daily or weekly withdrawals. Read the fine print.

SBA loan

- Best for:Larger projects and lower rates, when time is on your side.

- How it works:Government-backed, bank-funded; documentation-heavy; strong rates and terms.

- Timeline reality: Often 30–90 days to fund. Great tool, just not a “we need money tomorrow” tool.

How fast is “fast,” really?

Let’s set expectations. Many reputable online lenders advertise decisions within hours and funding within 24–48 hours. That’s realistic when:

- Your bank statements and financials are ready to upload.

- You respond quickly to requests.

- Your business has steady revenue history.

This is especially the case for working capital and lines of credit. But “as fast as 24 hours” always depends on underwriting and the specifics of your file.

On the flip side, SBA loans are powerful and can absolutely improve company finances over the long run—but they’re rarely next-day. Plan those for equipment, real estate, or refinancing projects.

The Titan Capital approach

Here’s how we help you keep financial management simple and sane:

- Multiple options, one conversation. We work with a broad lender network to match your need to the right product, not the other way around.

- Speed when it matters. Funding can be as fast as 24 hours once approved. We keep paperwork tight and expectations clear.

- Pair payments and capital. If you also process with Titan Merchant Services, we’ll look holistically at ways to reduce processing costs and improve cash flow alongside financing. That’s how we help you improve cash flow from both directions: lower outflows and faster access to business funds.

What documents should you gather now?

If you want a next-day decision, don’t wait until the cooler dies. Keep a simple digital folder with:

- Last 3–6 months of bank statements

- Recent business tax return (if available)

- Year-to-date P&L and balance sheet

- Driver’s license and voided check

- Merchant processing statements (if you accept cards)

Why prep now? Because speed equals leverage. When a distributor calls with a “today only” deal, you can move.

How much does fast capital cost?

It varies by product, risk, and term length. A few straightforward principles:

- Shorter is usually pricier per dollar. Convenience and speed carry a premium.

- Lines are flexible. You only pay for what you draw, which can be cheaper than a lump sum you don’t fully use.

- MCA costs can add up. Daily or weekly deductions plus factor rates can strain cash flow if sales dip. Only use MCAs when you’ve run the math and know the break-even. Titan’s business capital specialists will lay out typical timelines and tradeoffs clearly.

This is why matching the tool to the job matters. Use low-cost capital for long-term needs. Use fast capital sparingly and strategically for short gaps or urgent wins.

Real-world playbook: four ways to improve cash flow this quarter

Use these moves to tighten cash flow management and reduce the need for emergency funding:

- Shorten your payment cycle. Incentivize early payments and add late fees. QuickBooks data shows longer invoice waits correlate with more cash flow issues—so attack collections first.

- Right-size inventory. Shift to smaller, more frequent orders if carrying costs are high. Use vendor dating strategically rather than by default.

- Segment expenses. Put recurring bills on a predictable schedule and align line-of-credit draws to those dates. Treat the LOC like a thermostat, not an on/off switch.

Tie funding to ROI. If a short-term loan unlocks a discount bigger than the cost of capital, that’s a green light. If not, pause.

Remember: lots of businesses are operating with a two-week cash buffer. You’re not behind; you’re typical. The goal is to move from typical to intentional.

Fast capital vs. bank loans: a simple timeline

Bank/SBA loan

- Application: days to weeks

- Underwriting: weeks

- Funding: 30–90 days common for SBA

- Best for: big projects, lower rates, long terms

Next-day capital (online lenders)

- Application: minutes

- Underwriting: hours to a day

- Funding: 24–48 hours with many providers

- Best for: time-sensitive gaps and opportunities

Common questions, quick answers

Will applying hurt my credit?

Our initial application uses a soft pull, meaning it won’t affect your credit. If you accept an offer, expect a hard pull. Just work with our business capital specialists before you proceed on an offer.

Can I qualify with average credit?

Often, yes. Our lenders weigh revenue consistency heavily. That’s why updated bank statements matter.

What if I’m already using an MCA?

Be careful stacking advances. Review your effective total cost. Our specialists can help you model the math. Then let’s talk about ways to refinance into a healthier structure.

How fast is “24 hours” in real life?

If your docs are ready and the lender’s criteria fit your profile, next-day business capital is possible. If underwriting needs clarifications, it can take longer. We’ll be transparent either way.

The bottom line

Cash flow is the lifeblood of your business. When timing gets tight, next-day business capital can steady operations, protect your team, and let you pounce on opportunities. It won’t replace good financial management. It complements it. If you’re tired of waiting weeks for the bank to call back, we’re here to help you move faster—and smarter.

Apply with Titan Capital and see your options. With one simple application, we’ll match your needs to a lender in our network. Funding can be as fast as 24 hours after approval, and we’ll help you choose the right tool for the job.

Let’s get you the business funds you need to keep things moving.

P.S. Want a quick checklist?

- Create a “Funding Ready” folder with bank statements, YTD financials, and IDs. Decide your ceiling cost of capital and stick to it.

- Use a line of credit for short gaps; reserve long-term loans for long-term needs.

- If you process with Titan Merchant Services, ask us to review processing costs too. Lower fees plus the right capital = smoother cash flow.