Online payment options have been gaining traction even before the onset of COVID-19. We all know it is only a matter of time before stores and restaurants go fully contactless, but COVID-19 has served as a catalyst for the adoption of online payment methods. Reducing direct contact between staff and customer and therefore the possibility of transmission, many merchants have adopted contactless payment to give their customers peace of mind and encourage them to continue making purchases. Let us take a look at why businesses need to go for online payment options and POS systems in order to survive in the post-COVID world.

Increase in Number of Customers Using Online Payment Options

More and more customers are opting for touch-free payment methods in the post-COVID world. Even during the height of the pandemic, groceries and other essentials have to be purchased. In order to reduce risk of transmission, tap-to-go credit cards and e-wallets have emerged as the payment method of choice.

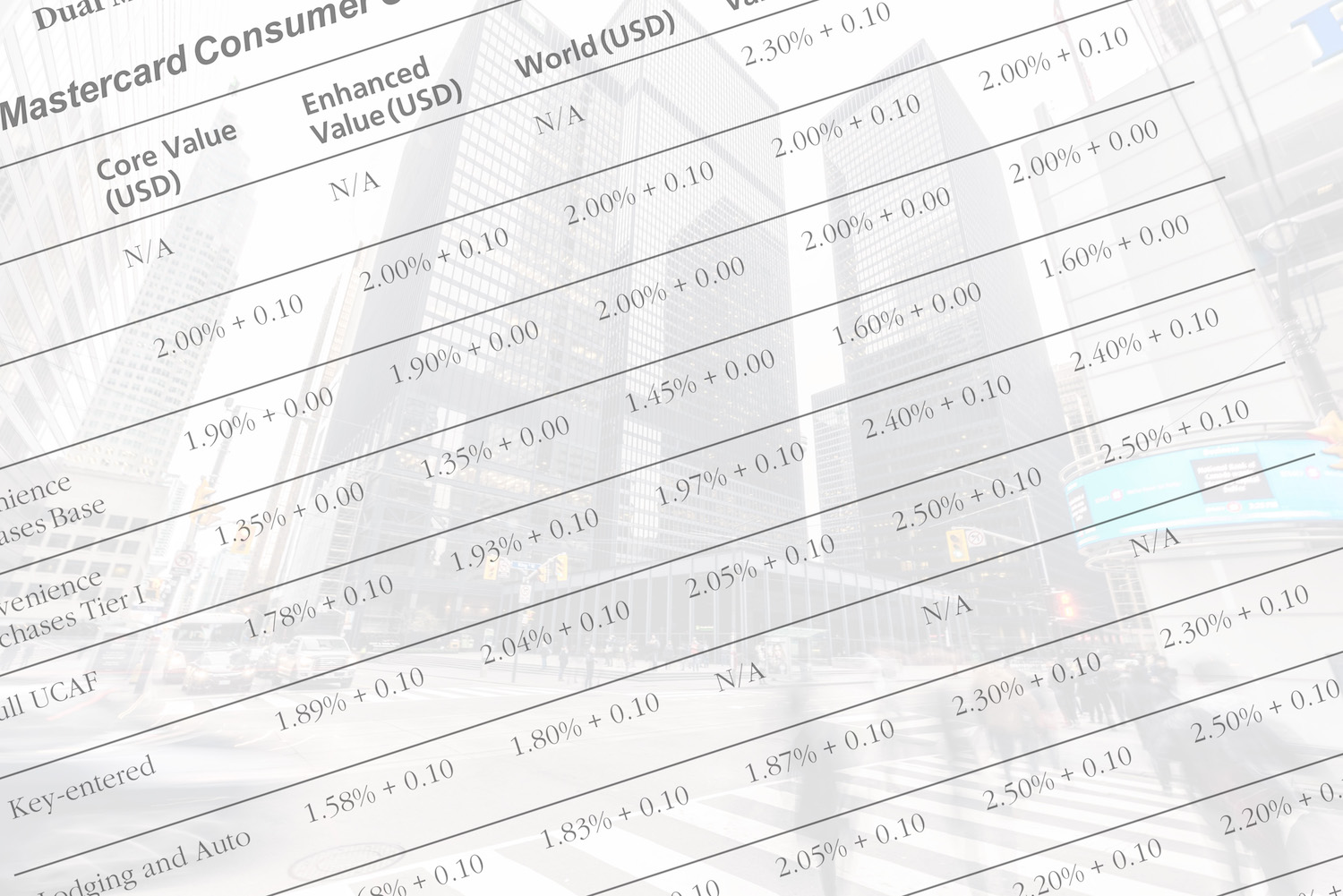

In a survey conducted in the United States, close to 60% of participants indicated that they were more likely to use online payment methods post-COVID. In addition, Mastercard has reported that almost 80% of users worldwide have made use of contactless payment since the outbreak. Clearly, the trend is here to stay even after things go back to normal. What does that mean for businesses who have yet to hop on the bandwagon?

Types of Online Payment Options

There are two main types of online payment options:

- Contactless debit and credit cards: When a customer pays with a contactless card, they simply tap it against a POS terminal to establish communication. A unique code is then generated. Because no authorization such as a PIN or signature is required, this makes contactless cards open to fraud. As a result, there is often a Cardholder Verification Limit (CVM), or the maximum amount a transaction can be in order to qualify for contactless card payment. Due to the increase in the number of contactless payments made, Mastercard has increased its CVM since the onset of the pandemic.

- E-Wallets: Electronic wallets are assessed via mobile phone apps, and popular e-wallets in the market include Google Pay, Apple Pay and Venmo. E-wallets are a more secure online payment option as sensitive data such as the card number is replaced with a token. This means that the actual card number never gets stored on the device. Payments with e-wallets can be made via the same POS systems used for contactless cards.

Work with Titan Merchant Services for Online Payment Options

If you have been convinced of the need to incorporate online payment options for your business, let Titan Merchant Services devise a personalized payment plan for you. From contactless card terminals to kiosks that enable customers to check out their purchases without human interaction, we have the perfect solution to suit the unique needs of your business.

If you have any inquiries about our touch-free POS systems, please feel free to contact us today.