On this page

Meta Description: Are you afraid of recession? Most small business owners in the US are. Here’s what you can do to plan for recession without cutting back on growth.

After reading a lot of outdated research papers, and fake statistics, we decided to actually go to the most credible sources, and speak with our own customers. We thought, “Why not just conduct a survey within our own customer base to see what’s the problem.” And the results? They speak for themselves.

Instead of writing another research article filled with generic advice, we decided to dig into what small business owners are actually saying. We pulled data from recent surveys of over 2,000 small business owners, combined it with stories from business owners we know personally, and what emerged was both sobering and surprisingly hopeful.

As we kept having more conversations, one thing became crystal clear: anxiety about the next recession is running high. The conversations were honest, sometimes raw, and surprisingly consistent. Many owners felt like they’re still recovering from COVID, only to be hit with rising costs, political instability, and competition from large chains. Some even asked me directly, “Are we living in another bubble?”

What stood out, though, wasn’t just the fear. It was the lessons these owners have learned from past downturns. And the creative ways they’re planning to protect their businesses without hitting pause on growth.

Sound familiar?

I’ve been helping small business owners navigate this exact nightmare for years now.

And here’s what I’ve learned: the payroll process doesn’t have to feel like you’re defusing a bomb every two weeks.

The Current Fears Small Business Owners Shared With Us

If you’re feeling anxious about the economy, you’re in good company. A recent survey found that 70% of small business owners believe we’re heading toward a recession. That’s not just paranoia – it’s a shared reality across industries and political lines.

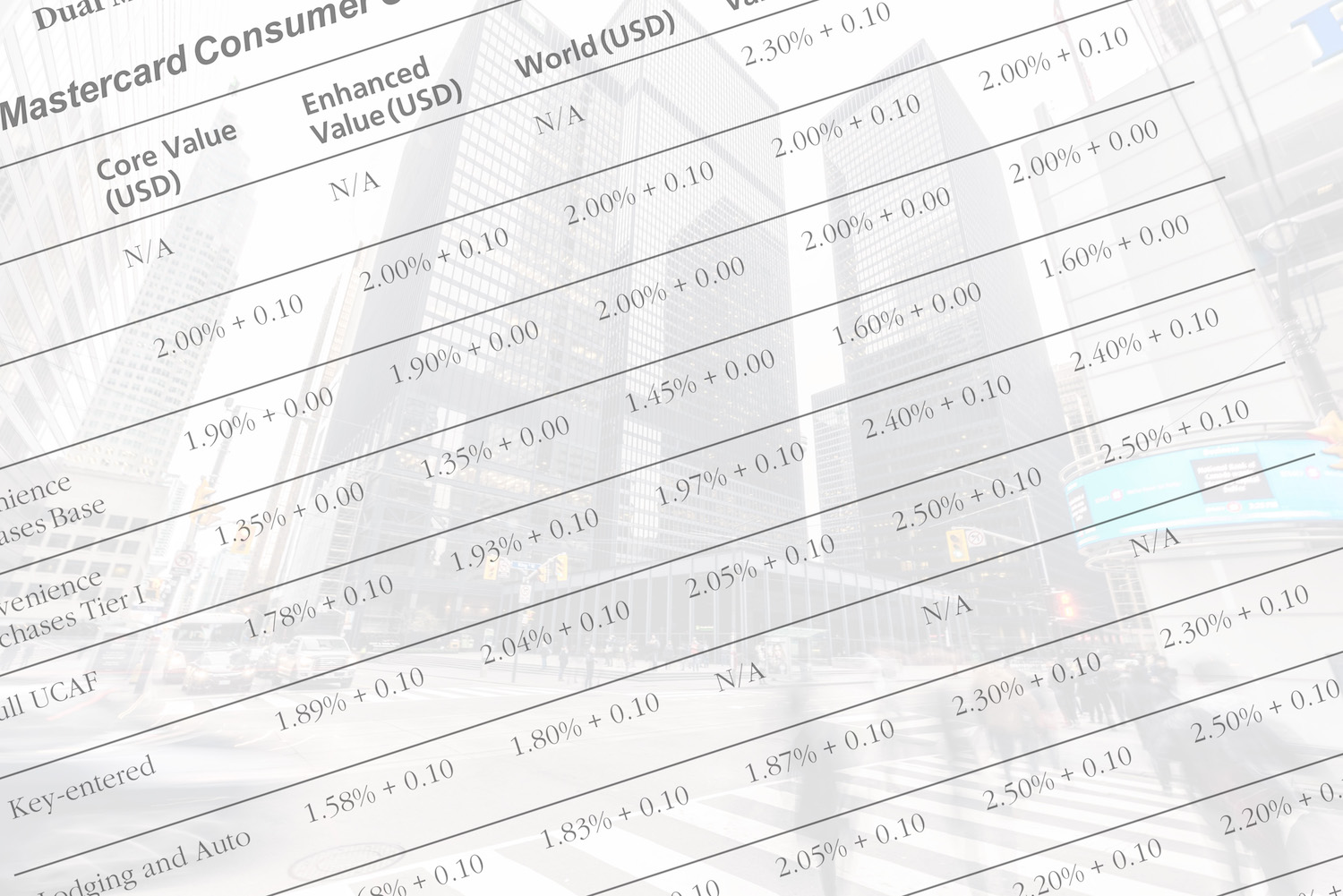

The top fears keeping business owners up at night:

- Inflation eating into profits (53% say this is their biggest worry)

- General economic uncertainty (35%)

- The dreaded R-word: recession (30%)

- Rising interest rates making everything more expensive (21%)

But here’s what surprised us: Despite all this worry, more than 70% of small business owners still want to grow and are actively looking for ways to thrive, not just “survive”.

We recall one retailer telling us:

“It’s like no matter how hard I try, there is no way I can compete with the big chains. They swoop in with lower prices, put us out of business, and then jack up the prices once they have no competition.”

And that felt like a gut punch. So true. So SO true. Just think about it, what seemed “affordable” and even “steal-deal” was just these corporations bleeding out the small business owners. Now that these smaller businesses are out of the race, the larger chains are raising their prices.

Lessons From Past Recessions

I’ve been working with small business owners long enough to have seen how they handle downturns. Let me share a few examples.

2008 Credit Crunch

A boutique gift shop I advised nearly went under when credit dried up. The owner told me she survived by renegotiating every vendor contract and moving to a leaner product mix. It wasn’t glamorous, but it gave her enough margin to ride out the storm. Today, she still uses those cost-discipline habits.

2020 Pandemic Shutdown

One restaurant client pivoted almost overnight. He launched online ordering, digital gift cards, and curbside delivery. By the time restrictions eased, his regulars were more loyal than ever, because he stayed connected during the crisis. His comment to me: “The recession forced me to modernize five years faster than I would have.”

Industry Shifts and Eligibility Requirements

I worked with a service business owner who admitted he ignored technology until competitors started eating his market share. The pain of losing accounts finally pushed him to adopt automated scheduling. He could now take orders online instead of hiring two people just to manage those orders. He told me later, “That was the turning point. I stopped playing catch-up and started leading.”

These aren’t just survival stories. They’re growth lessons born out of necessity.

Being at the Right Place: How Owners Are Planning Ahead This Time

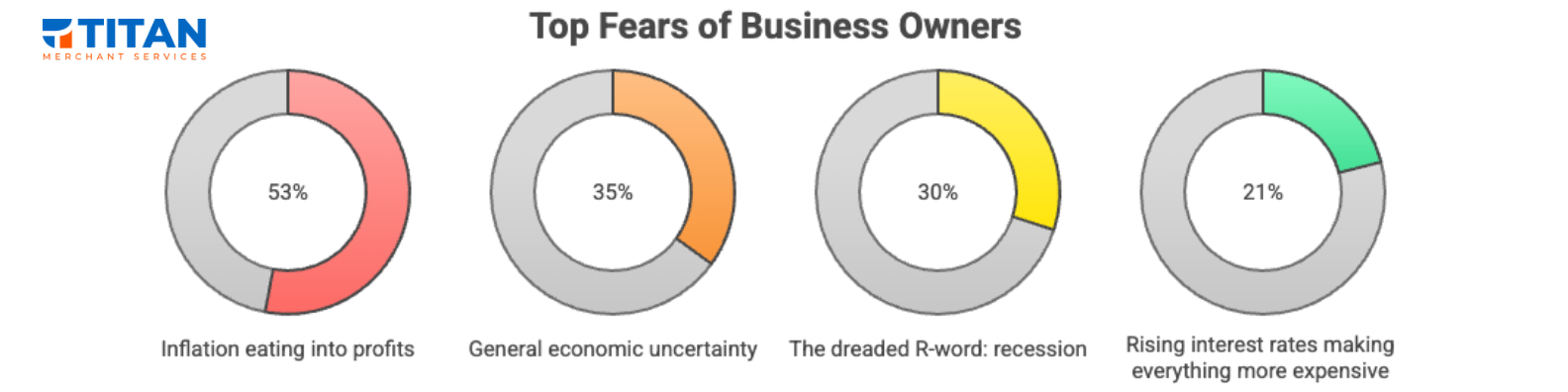

From my survey and conversations, I found that the new businesses preparing best for the next downturn follow a balanced playbook. It isn’t just theory — these are real stories, hard-earned lessons, and practical habits.

1. Financial Discipline

- Cash flow is non-negotiable. 66% of small businesses report financial challenges, and the #1 killer during recessions isn’t lack of customers – it’s running out of cash before things turn around. Here’s some pro tips for you to follow:

- Keep 3-6 months of expenses in easily accessible accounts (not invested, not tied up)

- Get aggressive about collecting receivables – that “30 days net” becomes “payment on delivery”

- Review every single recurring expense. One restaurant owner I know found $800/month in forgotten subscriptions

- Cutting hidden costs. A retailer shared how payment fees quietly crept up year after year. By switching to a transparent payment processing model, she freed up thousands to reinvest in store renovations.

- The 80/20 lens. Research often shows that 20% of actions bring in 80% of revenue. This is popularly known as the Pareto Principle. Dropping unprofitable accounts may give you room to upsell and grow stronger client relationships.

- Debt caution. One mechanic admitted: “I overleveraged before 2020 and nearly lost my shop. Now I grow slower but sleep better.”

2. Growth Mindset

This is where most businesses get it wrong. They either cut nothing (and bleed cash) or cut everything (and bleed customers).

Tom learned this running his plumbing business through 2008. “I almost cancelled my Yellow Pages ad to save $300 a month,” he admits. “Thank God I didn’t – that ad brought in $5,000 worth of emergency calls that winter.”

Smart cutting looks like:

- Eliminate waste, not capacity

- Cut costs that don’t touch customers

- Negotiate with vendors (you’d be surprised how willing they are to work with you)

- Review the 80/20 rule: which 20% of your business brings 80% of profits?

One landscaper told us he dropped his least profitable clients and focused on the ones who paid well and on time. His revenue dropped 15%, but his profit margin increased 40%.

Operational Resilience and Business Loans

Smooth operations can be the difference between stress and stability.

- Automation. A contractor admitted: “I was chasing checks for weeks, and it nearly broke me. Automating invoicing changed everything.”

- Loyalty programs. A boutique owner shared how her gift card program during COVID wasn’t just a cash lifeline but a trust-builder that helped her business expand. Customers wanted to help her stay afloat. The modern day loyalty programs don’t need punch cards. They automatically take care of bringing back customers.

- Metrics that matter. A bakery owner confessed she ignored financial reports until her margins collapsed. Now she tracks weekly and says: “It’s my safety net. I never want to be blindsided again.”

- Business loans. Not all debt is bad. In fact, in the famous book Rich Dad Poor Dad, Robert Kiyosaki says, “Good debt makes you rich, bad debt makes you poor”. The best entrepreneurs take calculated risks. They know how to balance the reward to risk ratio in just the right way.

Where Small Businesses Get Stuck

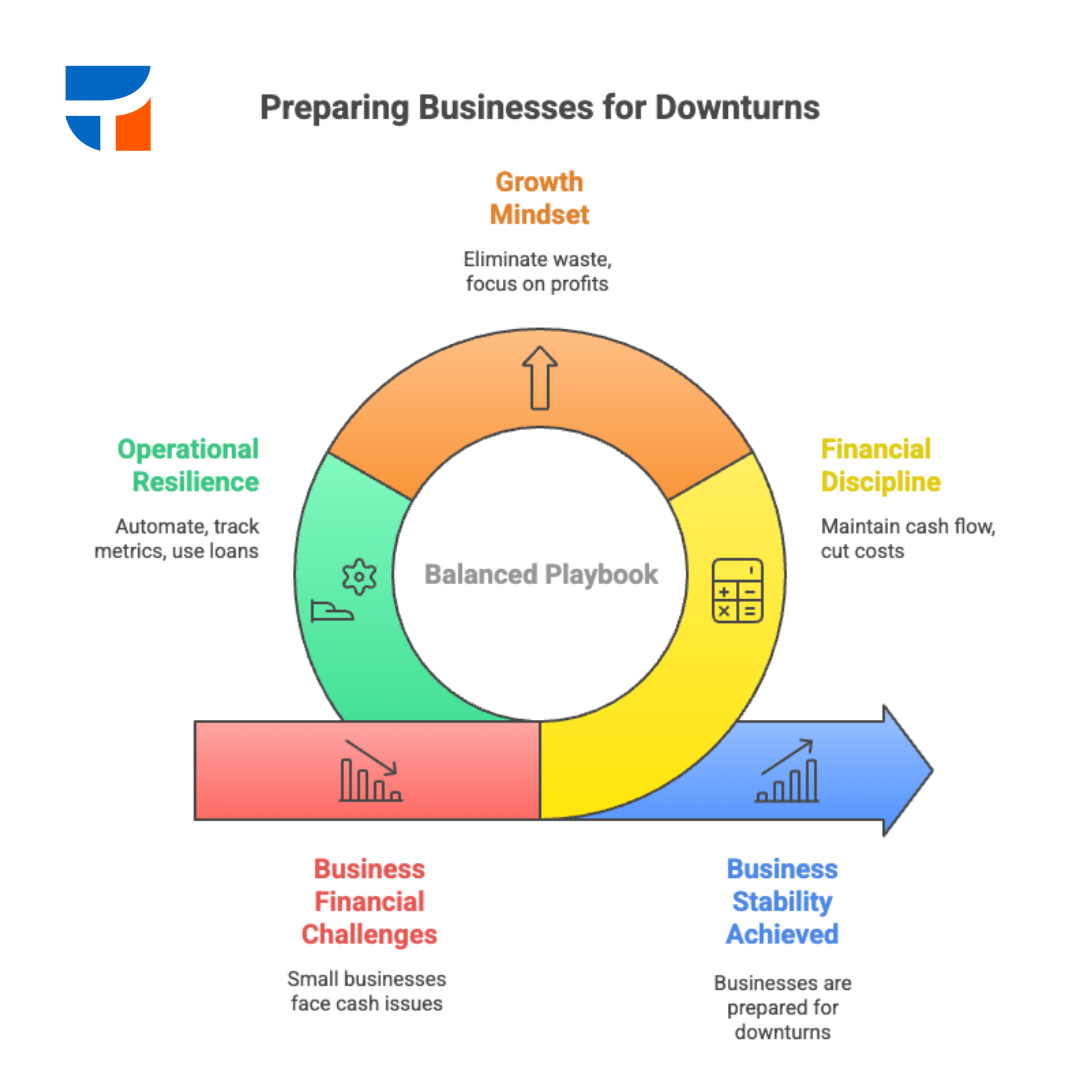

Even with the best plans, I’ve seen owners stumble in a few familiar ways:

- Decision fatigue: Too many choices lead to inaction. Traditional businesses are bombarded with so much information that they feel stuck and behind.

- Shiny object syndrome: Jumping into every new app or system drains focus. You probably don’t need a new site or heavy investment in social media. Maybe, your first focus should be cutting back on processing costs.

- Ostrich syndrome: Pretending everything is fine and making no changes. The businesses that die are often the ones that ignore early money warning signs.

- Lack of visibility: Ignoring financial reports makes problems invisible until they explode.

- Panic cutting: Slashing everything including marketing, customer service, and quality. You save money short-term but lose long term success and the ability to bounce back.

Going it alone: The business owners who make it through talk to other business owners, advisors, mentors. The ones who don’t tend to isolate themselves. That is exactly why we launched this email series. 🙂

Every business is different. Each has its own unique challenges, opportunities, benefits, and threats. So, they need different guidance. That said, the best practices we talked about here are applicable to all businesses no matter how big or small.

Our Biggest Takeaway From These Conversations

Small business owners aren’t just looking for survival tactics. They want growth strategies that actually work in a downturn. The smartest ones see recessions not as the end of the road, but as a reset. A chance to renegotiate, rethink, and reinvent.

Look, we can’t predict when the next recession will hit or how bad it will be. Nobody can.

But we can tell you this: the businesses preparing now will be the ones still standing when it’s over.

Start with an honest assessment:

- How many months could you operate if revenue dropped 30%?

- Which customers would you fight hardest to keep?

- What one investment could best position you for the next two years?

- Who’s in your corner when things get tough?

Where Titan Fits In with Small Business Grants and More

From what I’ve seen, the right tools make the difference between fear and confidence. That’s where Titan helps:

- Next-day and same-day funding keep cash flow steady.

- Transparent pricing models cut out hidden fees that eat margins.

- Loyalty and gift card programs help turn first-time buyers into repeat customers.

- Free-for-life POS equipment and digital invoicing give owners the tech edge without big upfront costs.

When I tell owners this, I see their shoulders drop a little, like someone just took a weight off. Because at the end of the day, recession-proofing isn’t about cutting to the bone. It’s about being smarter with the tools and strategies you already have.

Which half do you want to be in?