GET UP TO $26,000 PER

EMPLOYEE FROM THE IRS

It’s a Cash Refund Not a Loan

Over 500,000 businesses have claimed an average of $130,000 each. We specialize in helping businesses maximize their ERC (Employee Retention Credit) refund.

Get the refund your business is owed today.

Complete 2 Min Form Now

The Employee Retention Credit

Who can qualify?

From health care to hospitality, from construction to arts & entertainment, your business may qualify for the ERC if you meet at least one of these criteria.

Full or Partial Suspension of Operations

A Federal, State, or Local government shutdown order affected your business’ ability to operate in 2020 or 2021

Gross Revenue Reduction

Gross Revenues or Gross Receipts during 2020 and 2021 declined on a quarterly basis versus 2019

Recovery Startup Business

Business was started after Feb 15, 2020 and annual gross revenue was less than $1,000,000

Why work with us?

We make the process of applying for your Employee Retention

Credit a breeze and do all the heavy lifting

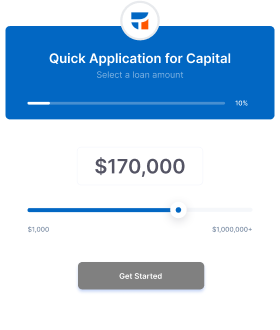

A fast and

easy digital application form

Dedicated Support

We have a team of experienced professionals ready to answer your questions and maximize your credit.

Details of the Program

- Up to $26,000 per employee

- Qualify even if you received PPP

- The window for filing is closing

- Businesses qualify if their revenue declined OR if they were affected by government mandates and shutdowns

- No size limit on refund amount

- Size of credit could exceed your tax bill

Our Process

We will quickly and accurately process your ERC claim,

maximizing the amount of your refund and delivering the funds to you as soon as possible

Step 1

Our experts analyze your business’ existing financials. We do all the work.

Step 2

Our expert team works to maximize your ERC cash refund.

Step 3

We create the necessary IRS filings and review them with you for final sign-off.

Step 4

Your filings are submitted to the IRS and your ERC cash refund is delivered to your bank account.

FAQ

Wondering how we help you with the ERC?

We’re an open book.

The Employee Retention Credit (ERC) is a refundable tax credit and not a loan. It is a stimulus program created by Congress to compensate businesses that retained employees during COVID. The program is complex, but many businesses are eligible, even if they had a PPP loan.

Your business may qualify for a maximum of $26,000 per employee, but most businesses do not qualify for the full amount. Accelerate Tax can help your business get the highest refund possible.

It can take anywhere from several months to over a year to receive your refund check. We can help your business get your refund immediately, however. Be sure to ask one of our specialists how.

Yes. You may be eligible if you were affected by a partial or complete government shutdown. You may also be eligible due to a decline in quarterly revenue. There are many ways to qualify, and we can help your business maximize your ERC.

If your business qualifies for our advance payment option, you could receive your refund check within a few days.

After our CPAs prepare the filing, the IRS sends out a physical check in the mail. That’s it!

Our team focuses exclusively on helping businesses maximize their ERC tax refunds. Eligible businesses can also receive their tax refunds upfront without waiting.

Unlike the Paycheck Protection Program (PPP), most banks and financial institutions are not participating, and many accountants are excluded because of the complexity for determining qualification and credit size

Even if your business received a PPP loan, you may still be eligible for ERC. PPP loan forgiveness may reduce the size of your ERC in certain quarters, depending on the amount forgiven and other payroll information. Our CPAs are experts in maximizing your ERC.

The ERC guidelines created by the IRS are over 200 pages long and have changed many times. Our CPAs specialize in the ERC and can help clients receive 15-25% more money than other firms.

Claim Your Government Stimulus!

If your business was harmed during the 2020-2021 pandemic, you may be eligible for an Employee Retention Credit and could receive up to $26,000 per employee regardless of your size or revenue.